Mauritius amends 19 laws to reinforce its Anti-money laundering regime

In May 2020 the European Commission (EC) added Mauritius to its draft list of high-risk third countries with strategic deficiencies in their money laundering prevention regimes, along with nine other jurisdictions. The Mauritius government issued a communiqué, protesting its inclusion, noting that it was given no opportunity to make representations before the list was published, and that the EC did not have regard to the differences between countries on the FATF monitoring list.

Mauritius has made the necessary changes in order to rectify the situation. The new Act introduced the following amendments (as well as others):

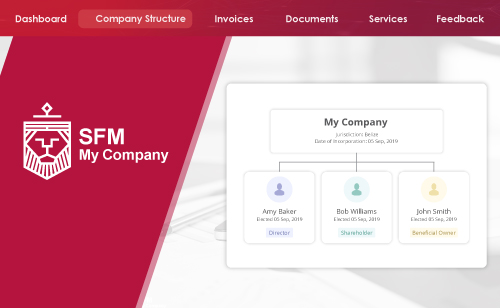

- All new companies, including limited liability partnerships, limited partnerships and foundations must disclose their beneficial ownership information to the Registrar of companies upon incorporation and registration. This information must also be confirmed later when making mandatory filings. Existing entities will have to provide this information when requested by authorities.

- Regulated persons will only have 5 days from the day of discovery to report suspicious findings to the Financial Intelligence Unit. This includes all suspicious transactions.

- The Bank of Mauritius and other regulators have now been given broader powers to supervise and examine the operations and affairs of their licensees.

Fines for non-compliance have been increased to a maximum of MUR10 Million. For serious offences, regulated persons can face up to 5 years in prison.

By enacting the Anti-Money Laundering and Combatting the Financing of Terrorism (Miscellaneous Provisions) Act, Mauritius amended 19 existing laws in order to comply with Financial Action Task Force (FATF) ant-money laundering (AML) recommendations, in a bid to be removed from the European Commission’s list of ‘high risk’ third countries.